Alternative Investments

Transparent Portfolio Performance Reporting

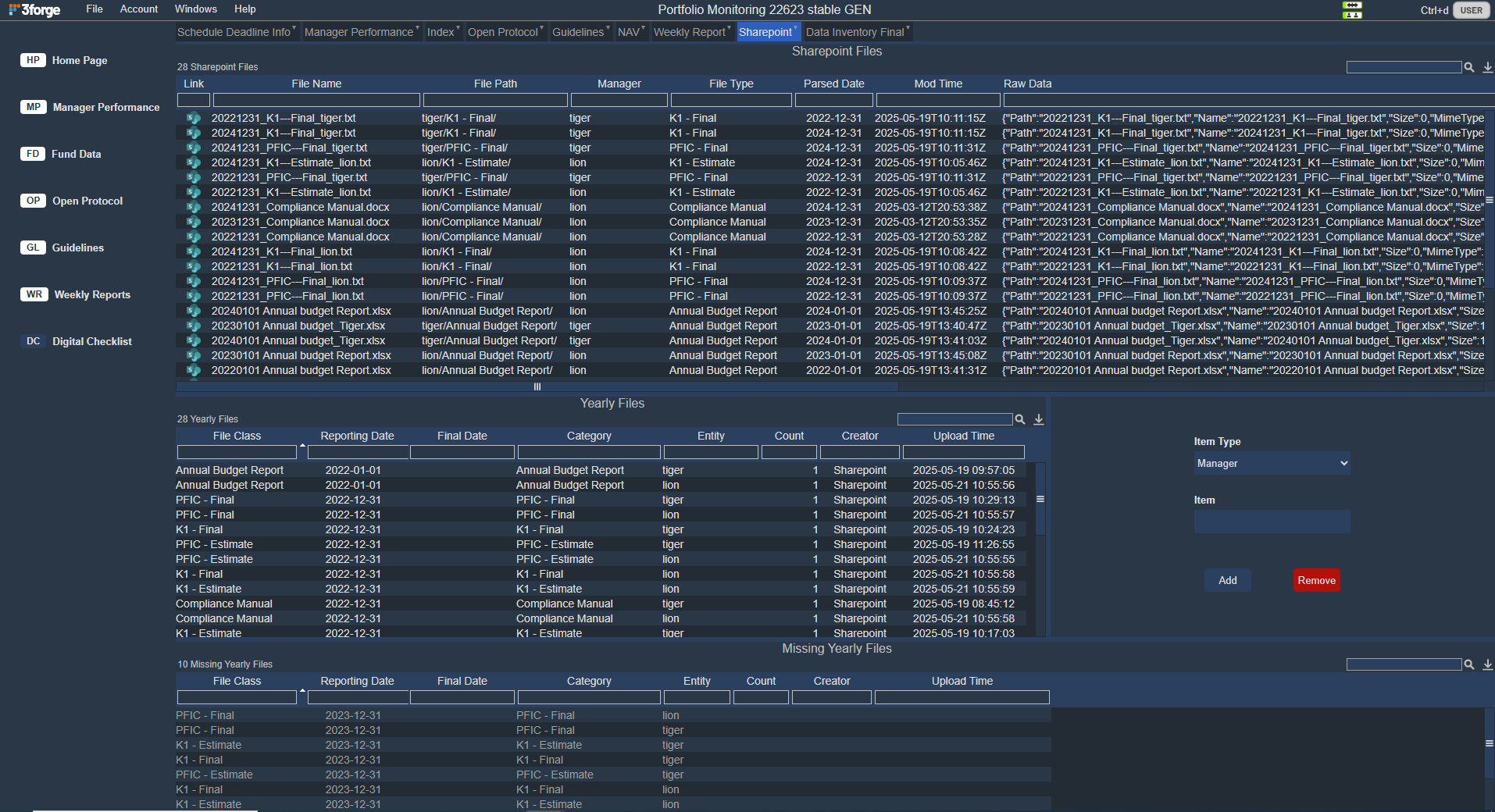

3forge delivers a comprehensive solution to consolidate portfolio analytics across investment managers, combined with real-time data aggregation for advanced reporting.

3forge delivers a comprehensive solution to consolidate portfolio analytics across investment managers, combined with real-time data aggregation for advanced reporting.

Alternative investment managers face increasing pressure to deliver accurate, timely, and transparent reporting across complex portfolios that often span multiple asset classes, strategies, and data sources. Manual processes and siloed systems create inconsistent views of performance, risk, and exposures—undermining investor trust and increasing operational risk. These challenges also make it harder to meet the evolving transparency and auditability standards of institutional investors and regulators.

3forge provides a comprehensive portfolio monitoring and reporting platform designed for the complexities of alternative investment strategies. The solution:

Aggregates and normalizes data — integrating live and historical information across asset

classes, managers, strategies and multiple systems or data sources

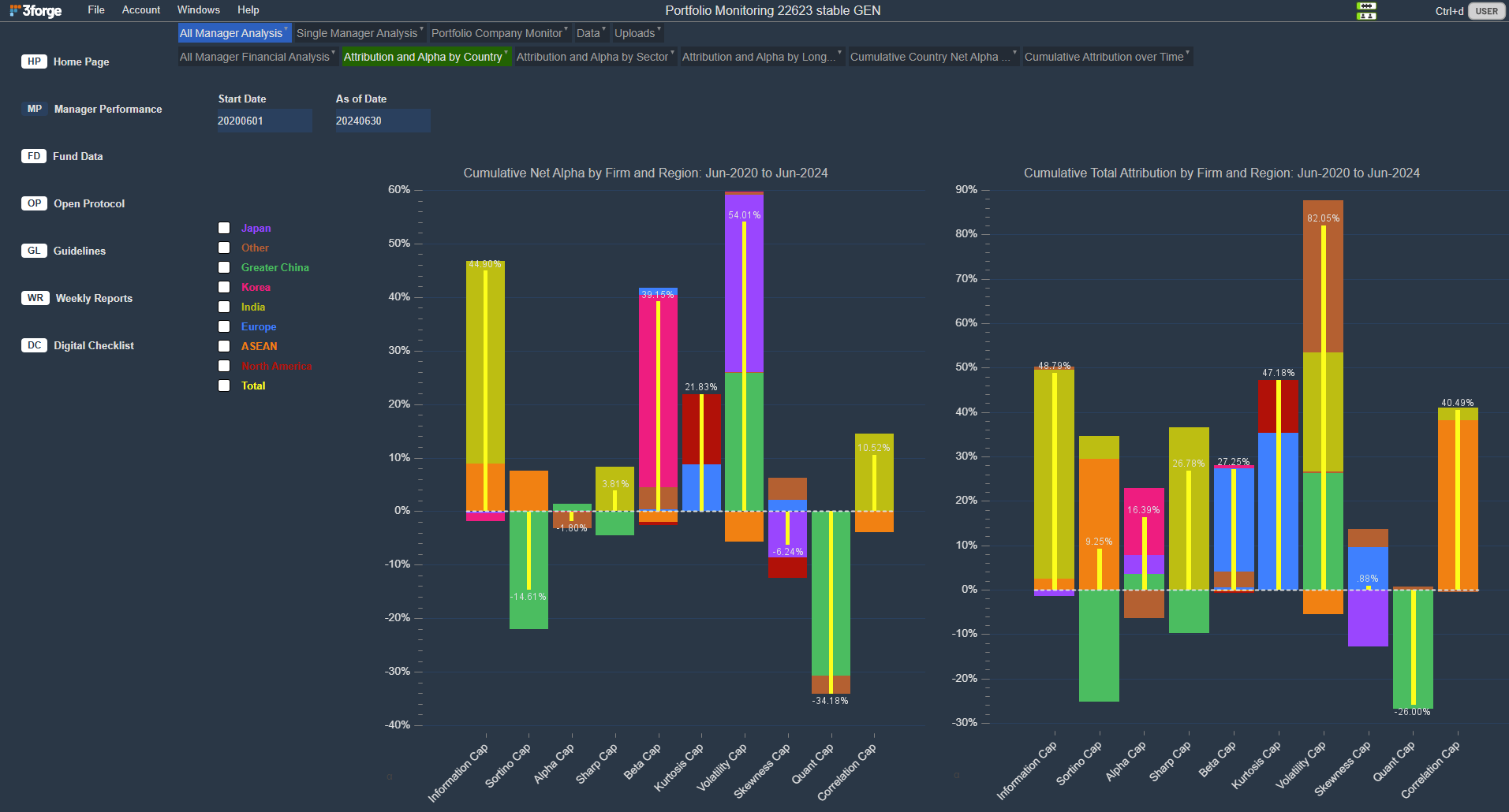

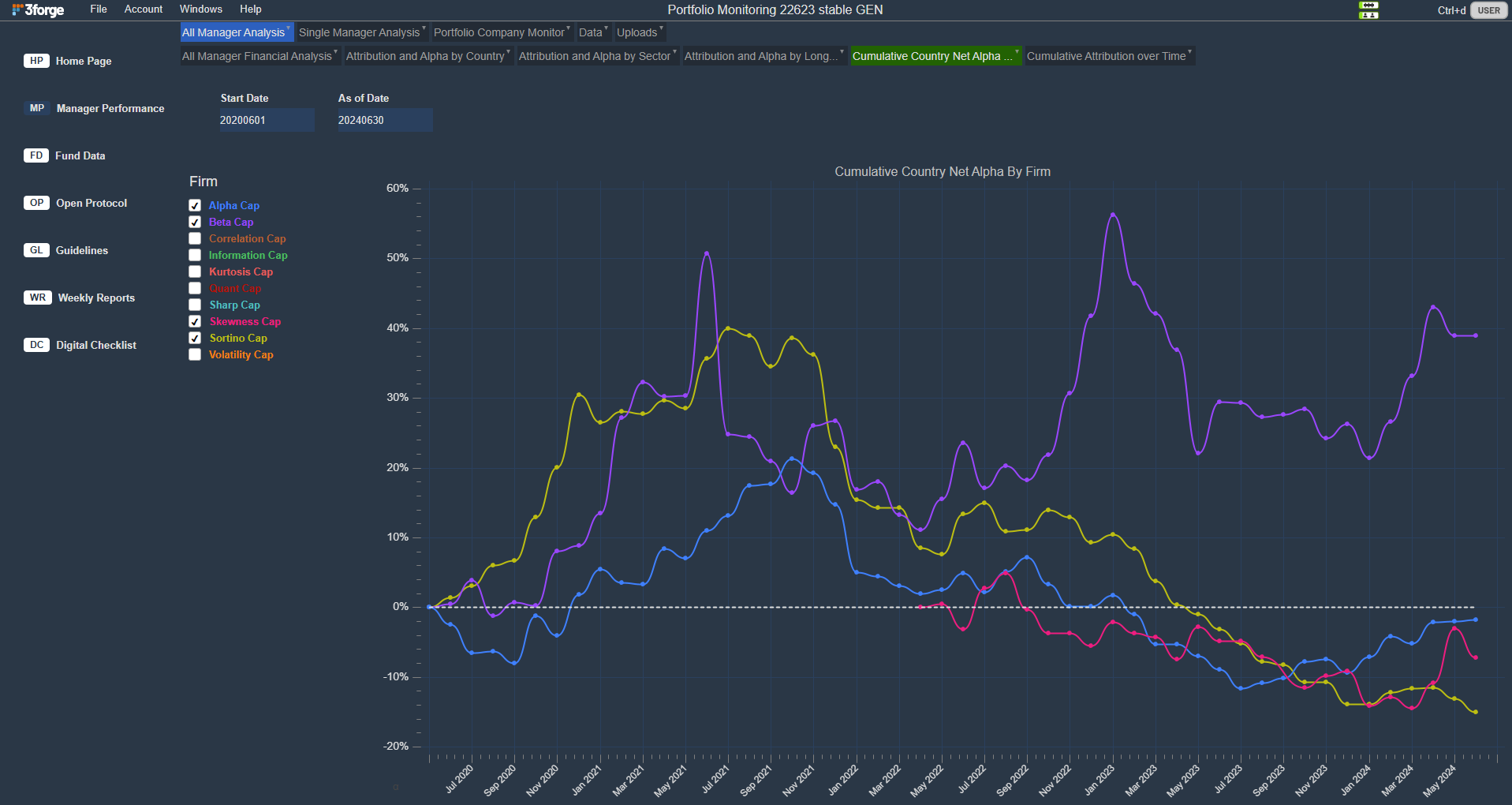

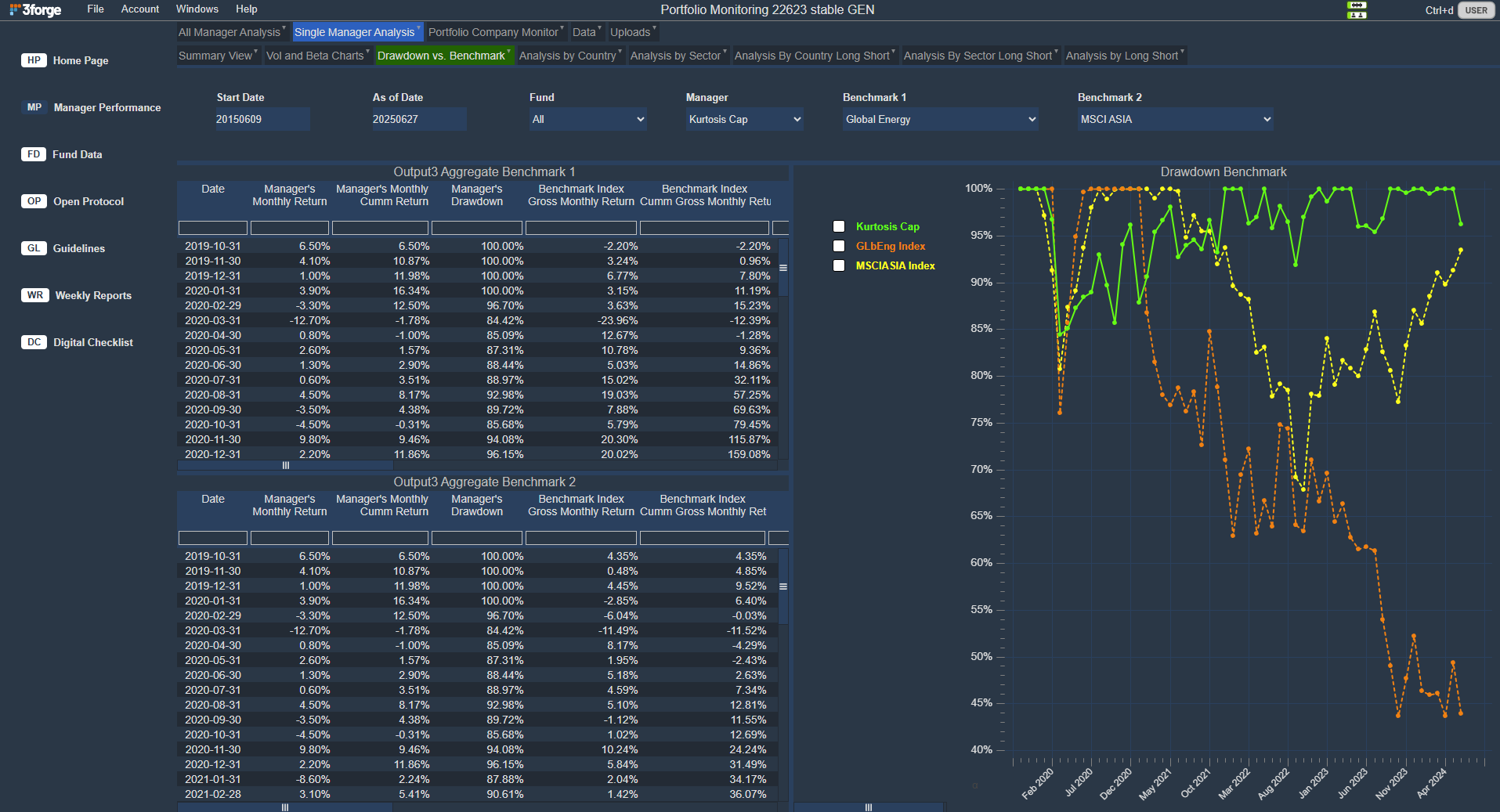

Performs advanced analytics — including net and gross returns, volatility, attribution,

Sharpe ratio, alpha, and benchmark correlations

Enables multi-dimensional analysis — across AUM, performance, and growth by

manager, strategy, sector, region, market cap, and long/short exposure

Delivers customizable reporting — allowing users to generate on-demand, investor-ready

reports via PDF or email, tailored to stakeholder and regulatory requirements

Portfolio Performance reporting

Explore more comprehensive

portfolio performance insights

Unified Portfolio View

Portfolio managers often rely on fragmented tools and manual processes to monitor complex portfolios, making it difficult to achieve a unified and comprehensive view of exposures, performance, and risk. By aggregating multiple data sources into a single, coherent interface, 3forge delivers consolidated visibility across asset classes, strategies, and managers—enhancing clarity, improving oversight, and enabling faster, more confident decision-making.

Comprehensive Cross-Asset Transparency

Portfolio managers require a holistic view across a diverse set of underlying managers and asset types —not just within, but across strategies. 3forge enables comprehensive transparency into exposures by geography, sector, market cap, and return characteristics, with additional insights into volatility (where relevant), peer benchmarking, and position sizes. The platform supports detailed look-through reporting on underlying holdings and asset sizes, helping managers better understand concentration, overlap, and portfolio composition across the funds they invest in.

Flexible, Customizable Reporting

Traditional reporting tools often rely on rigid templates, limiting the ability to respond to unique analytical needs, client-specific requests, or ad-hoc inquiries. 3forge enables highly flexible report generation—whether in PDF, email, or dashboard form—easily tailored to evolving business requirements, investor preferences, or one-off deep dives. This adaptability ensures that managers can deliver the right information, in the right format, at the right time.

Granular Entitlement Controls

Lack of fine-grained access controls can expose firms to compliance risk—either by overexposing sensitive data or restricting visibility needed by legitimate stakeholders. 3forge combines enterprise-grade SSO, OAuth, and SAML integrations with robust Role-Based Access Control (RBAC), allowing firms to define and enforce precise data entitlements. This ensures secure, compliant, and context-appropriate access to information—whether by user, role, portfolio, or data element.

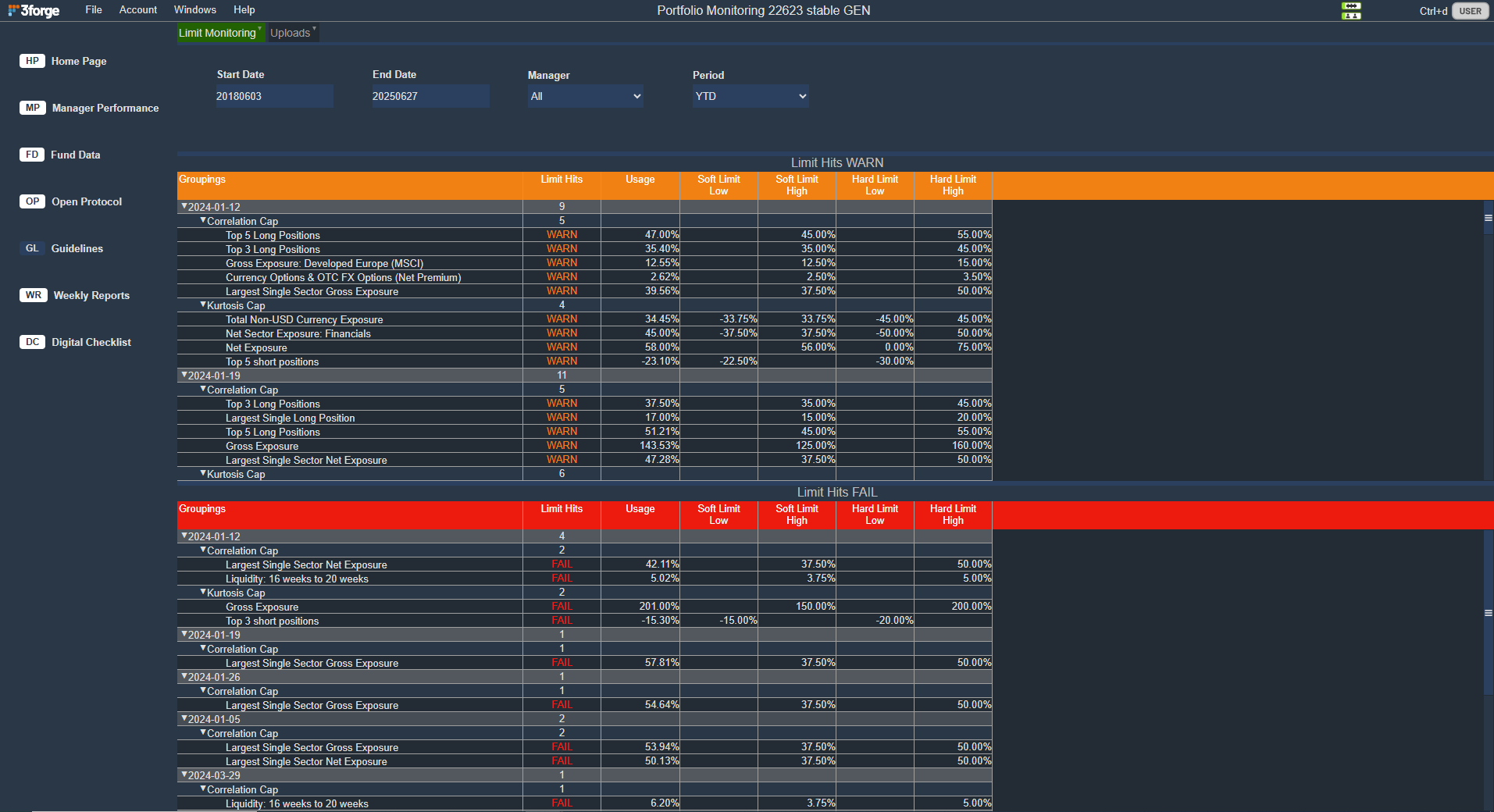

Automated Data Validation and Reduced Operational Risk

Manual data handling and outdated validation approaches often lead to unreliable insights, inefficiencies, and heightened operational risks. 3forge addresses these challenges through automated data validation, enrichment, and cleansing workflows that significantly enhance data quality while reducing the need for manual intervention. By automating data handling, alerting, and reporting processes, organizations can minimize errors, improve accuracy, and free up resources for more strategic initiatives—ultimately ensuring more reliable insights and lowering operational risk across the reporting lifecycle.

Advanced Data Modeling and Interactive Analytics

3forge combines sophisticated data modeling—capable of supporting arbitrarily cascaded and multiplexed structures—with dynamic, interactive visualization tools tailored to alternative investment portfolios. This flexible architecture accommodates any topology or arrangement of computation logic, enabling investment professionals to efficiently implement complex strategies and clearly express data design. Real-time pivot tables, drill-down trees, and custom visual workflows allow seamless exploration of exposures, risk factors, and performance drivers—transforming intricate portfolio data into actionable insights.

Save time and increase reporting accuracy with a holistic portfolio performance dashboard:

Imagine launching a multi-strategy hedge fund capable of integrating real-time data, seamlessly managing global operations, and exceeding even the most ambitious executive expectations from day one. This is the story of Jain Global, the largest hedge fund launch since 2018, which leveraged 3forge's advanced platform to redefine operational efficiency and scalability. From overcoming launch challenges to managing intricate operations across seven diverse business lines, this case study reveals how 3forge enabled Jain Global to achieve unparalleled success.