Sharpen your trading edge

FX Transaction Cost Analysis (TCA)

Optimize execution quality, liquidity exposure, and pricing strategies with real-time transparency in a fragmented FX market.

Optimize execution quality, liquidity exposure, and pricing strategies with real-time transparency in a fragmented FX market.

Foreign exchange (FX) markets are inherently fragmented. With trading spread across multiple venues, platforms, and liquidity providers, the quality of execution can vary significantly. Participants must continuously monitor performance, pricing efficiency, and market impact to stay competitive.

Liquidity providers must strike a delicate balance between internalization, yield, and fill ratios while mitigating signaling risk. Meanwhile, price takers must avoid bloated liquidity stacks and identify their most reliable counterparties to prevent unnecessary slippage and cost.

Traditional TCA solutions tend to deliver post-trade reports, offering insights only after the opportunity to act has passed. In a fast-moving, opaque environment like FX, that's not good enough.

FX traders

FX Market Makers

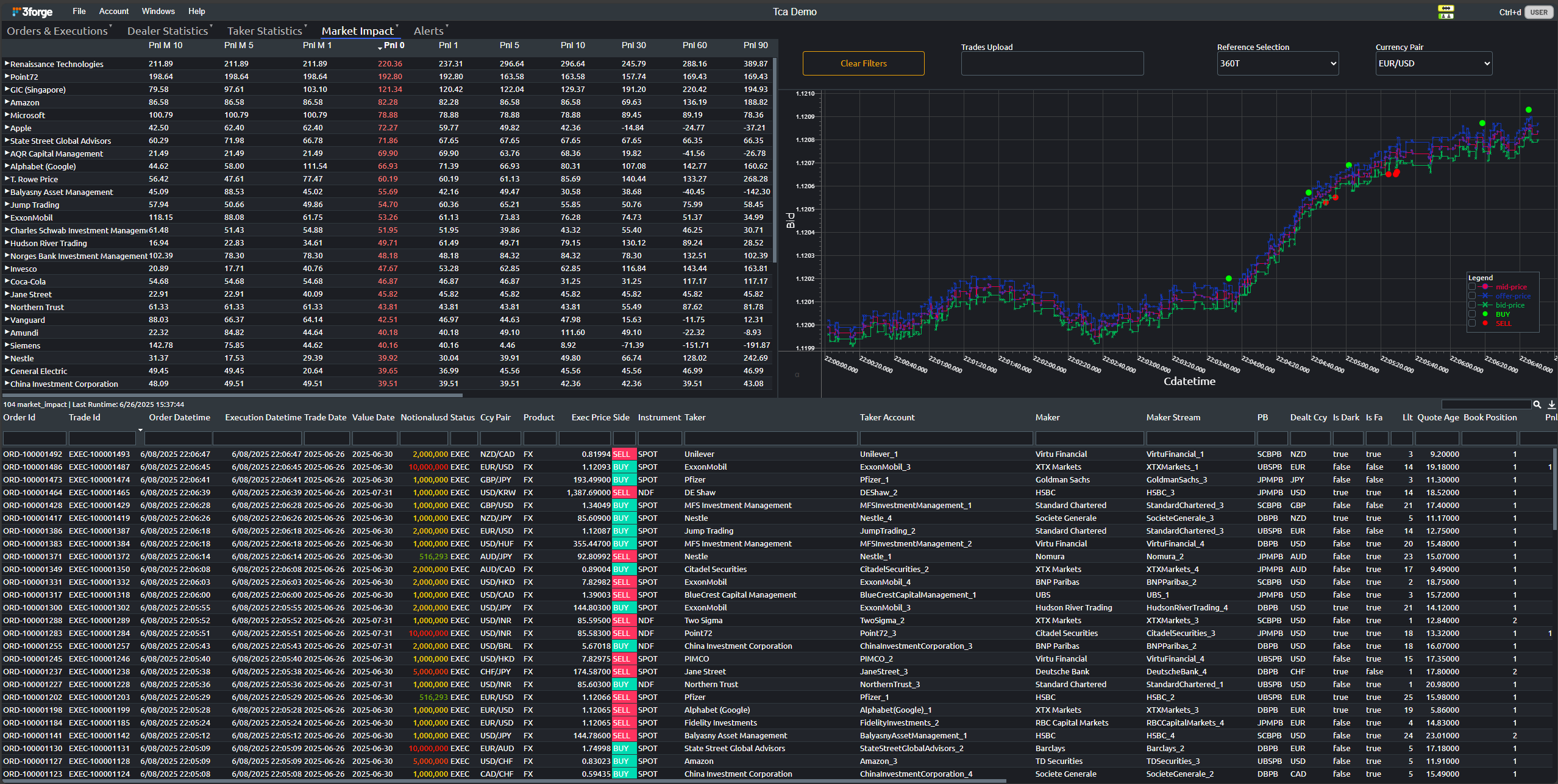

3forge empowers FX trading teams with a real-time, interactive TCA platform purpose-built for high-frequency, high-volume environments. By combining streaming and historical data into a single customizable interface, 3forge enables users to measure, benchmark, and optimize execution strategies dynamically across four key pillars:

With 3forge, liquidity providers and price takers alike can calibrate their strategies based on live metrics, automated alerts, and deep historical context with sub-second responsiveness.

Monitor trade execution quality in real time with precise market impact analytics. Identify slippage, signaling effects, and adverse price movements across counterparties and instruments. Optimize execution decisions by comparing pre- and post-trade impact against different benchmarks dynamically.

Real-Time and Historical Fusion

Seamlessly integrate streaming and archived data to enable continuous, full-spectrum analytics across trades, quotes, and benchmarks.

Custom Dashboards for Every Role

Tailor visualizations for traders, liquidity managers, and risk teams: each can focus on the metrics that drive their decision-making.

Quote Lifecycle and Latency Analytics

Track quote-to-trade match rates, last-look behavior, and latency profiles to fine-tune quote aggressiveness and internalization.

Signaling Risk and Market Impact Curves

Visualize how flow affects spreads and pricing behavior to detect asymmetric slippage and avoid negative market feedback loops.

Algo Strategy Benchmarking

Compare TWAP, VWAP, and risk-transfer performance against real-time market conditions and customizable benchmarks.

Anomaly Detection and Alerting

Trigger real-time alerts when fill rates deviate, quote frequency drops, or market impact exceeds expected thresholds.

Scalable, High-Performance Engine

Ingest and process millions of data points per second with ultra-low latency, ideal for high-frequency FX trading environments.

Bring transparency and precision to every FX trade with real-time TCA built for fragmented, fast-moving markets.